Crypto startups that build disruptive blockchain technology face a series of marketing challenges including competition from incumbent solutions, educating your target audience, raising brand awareness, generating leads, and increasing users.

Add the fact that many crypto startups are open-source projects, and you get founders, core developers, and advocates forced to find creative ways to market their product.

While more traditional marketing efforts like email marketing, social media marketing, and podcasts have a rightful place in the blockchain marketing stack, these examples are going to focus on some of the most creative strategies we've seen Web3 projects deploy.

Let's take a look at thirteen unique crypto marketing strategies that have each resulted in massively successful crypto marketing campaigns.

1. Optimized GitHub Documentation

Whether your crypto project is building a suite of powerful APIs like Blocknative, or creating an entirely new blockchain, developer documentation and a well-organized Github repository are incredibly persuasive marketing tools.

If we recall from our previous blog, blockchain marketing communication tools, value tends to accrue as a project’s community, network effect, and ecosystem expands.

In this highly competitive space, one way to keep an edge is by creating the best documentation for your developer community. Ultimately, you will empower them to build quickly, find answers to common questions, and most importantly refer you to other builders in their network who will integrate your solution into their product.

Like tracking community size on Discord, Reddit, or other social media platforms, investors, builders, and users also look at your GitHub profile (e.g. repos, saved repositories, etc.) to evaluate the strength of your project.

GitHub tracking platforms like Crypto Miso help people see how active your developer community is by tracking the number of commits (saved changes).

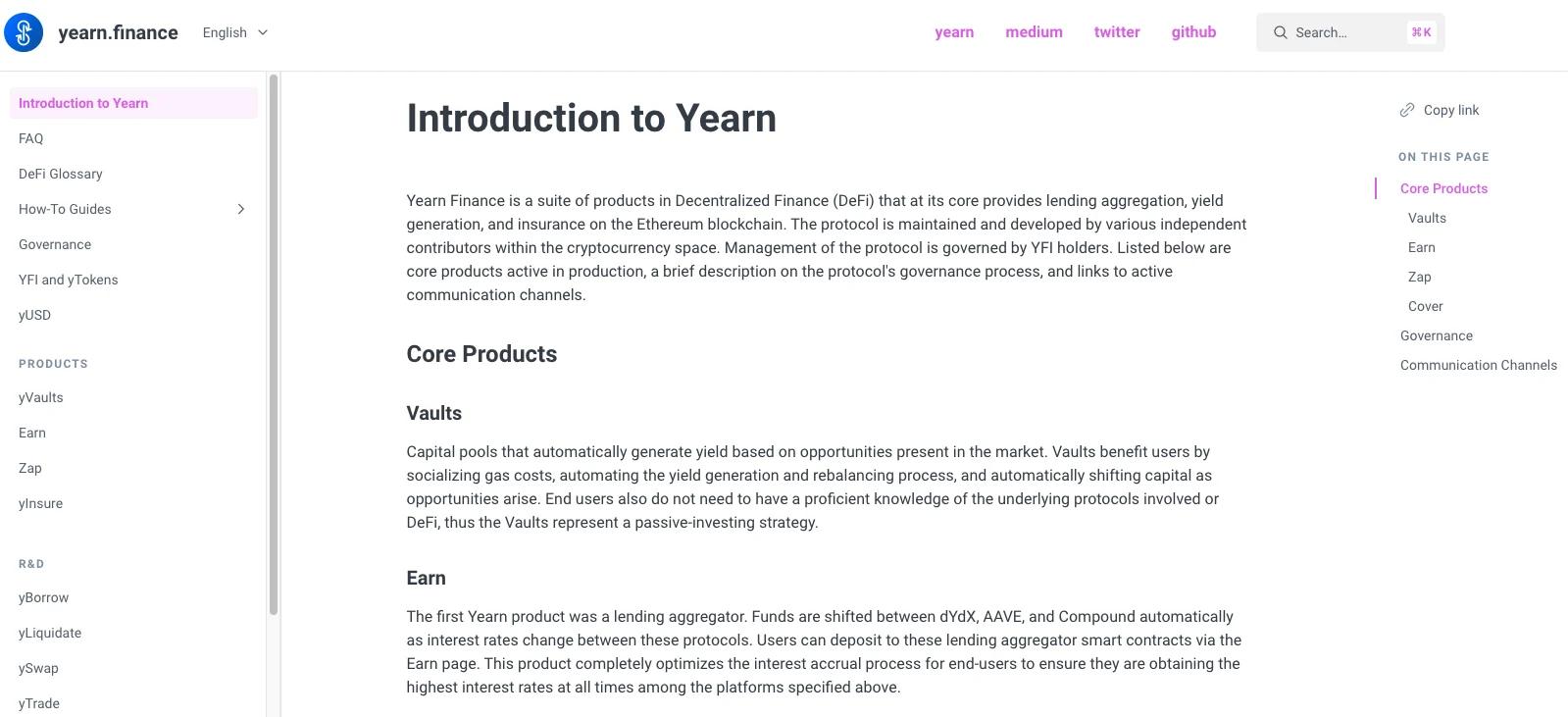

Yearn Finance's GitBook Documentation

Yearn Github

While GitHub is primarily for hosting codebases, platforms like GitBook offer teams a simple tool for organizing developer documentation away from their crypto website.

Yearn Finance is one of Ethereum’s blue chip DeFi protocols. Known as a yield aggregator, Yearn automatically allocates its user's funds across different yield farms to maximize the interest accrued on their investments.

While Yearn Finance might be difficult to understand from a financial or technical point of view, the clarity, organization, and simplicity of their GitBook documentation make it easy for developers to build, and crypto enthusiasts to participate in one of the most exciting decentralized finance projects in today's market.

2. Website Redesign

Has your crypto website grown alongside your startup, or has it stayed the same? Is it fast, secure, and scalable?

A common shortcoming for Web3 companies is a marketing website that lacks in performance, creativity, and search engine optimization. Simple platforms like Wordpress are great for getting you up and running, but if you see enough success, you will certainly outgrow it.

If you want to build an enterprise level website, you need to explore more capable frameworks like React, and more robust content management systems like Contentful.

A website is your most valuable marketing asset, and if you treat it like one of your own products, you can reap the endless benefits.

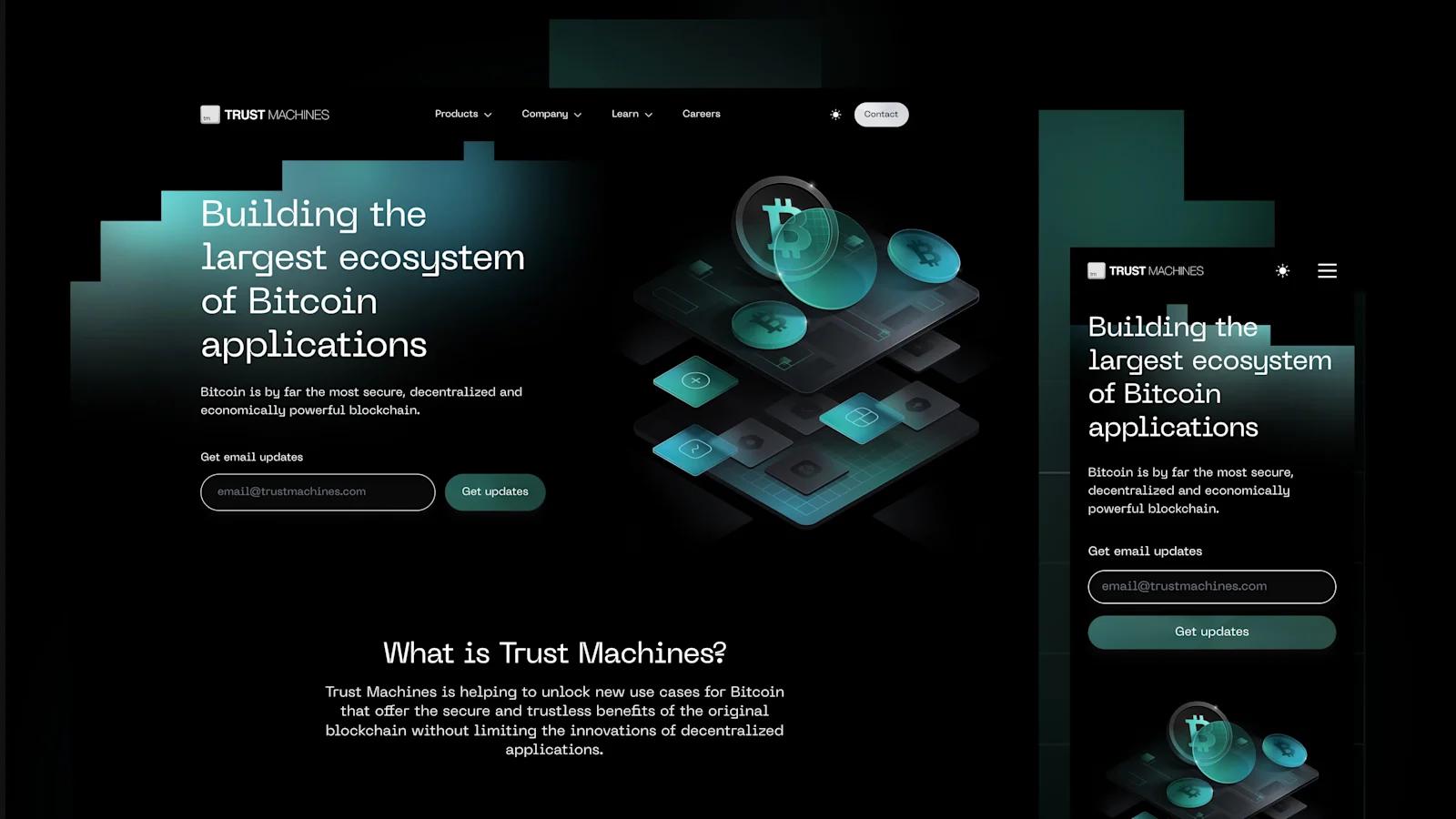

Trust Machines Marketing Website

Trust Machines Homepage

Trust Machines is a startup that is building applications and technologies on top of the Bitcoin network. In early 2022, the team raised $150 million in funding for developing Bitcoin into an ecosystem for Web3.

At the time of their announcement, they had a 2 page website, with very little content. They recognized the importance of establishing a brand that was professional and trustworthy within Web3 - and came to Webstacks to build a first-class website.

The Trust Machines site got an upgrade from a Squarespace template to a custom website designed with Figma, and powered by the latest web technologies in Gatsby.js (a React framework) and Builder.io (a Visual Editor CMS).

We helped Trust Machines establish a unique identity inspired by Web3 design, and created a collection of educational blog posts related to “building on Bitcoin”.

Trust Machines was an epic success story. Check out our Trust Machines Client Story - where we highlight the entire project and explain the value of investing in your crypto website.

3. Yield Farming

Since we're on the topic of yield aggregators, let's talk about yield farming. Yield farming on decentralized exchanges (DEX) is probably the most well-known and effective marketing strategy for token-based crypto businesses.

That’s a mouthful, so let's break it down in two sentences.

A decentralized exchange allows investors to trade digital assets against a giant pool of tokens where prices are based on a mathematical formula (e.g. a constant product function that can be found in Automated Market Makers), which eliminates the need for a centralized entity to match orders between market participants.

Yield farming is when investors who own a project’s token earns interest by providing liquidity (i.e. adding their tokens to the giant pool) so traders around the world can buy and sell freely.

Because yield farming enables investors to earn interest (sometimes greater than 100% APY), it attracts lots of investors to buy, hold, and earn a yield on the project’s token.

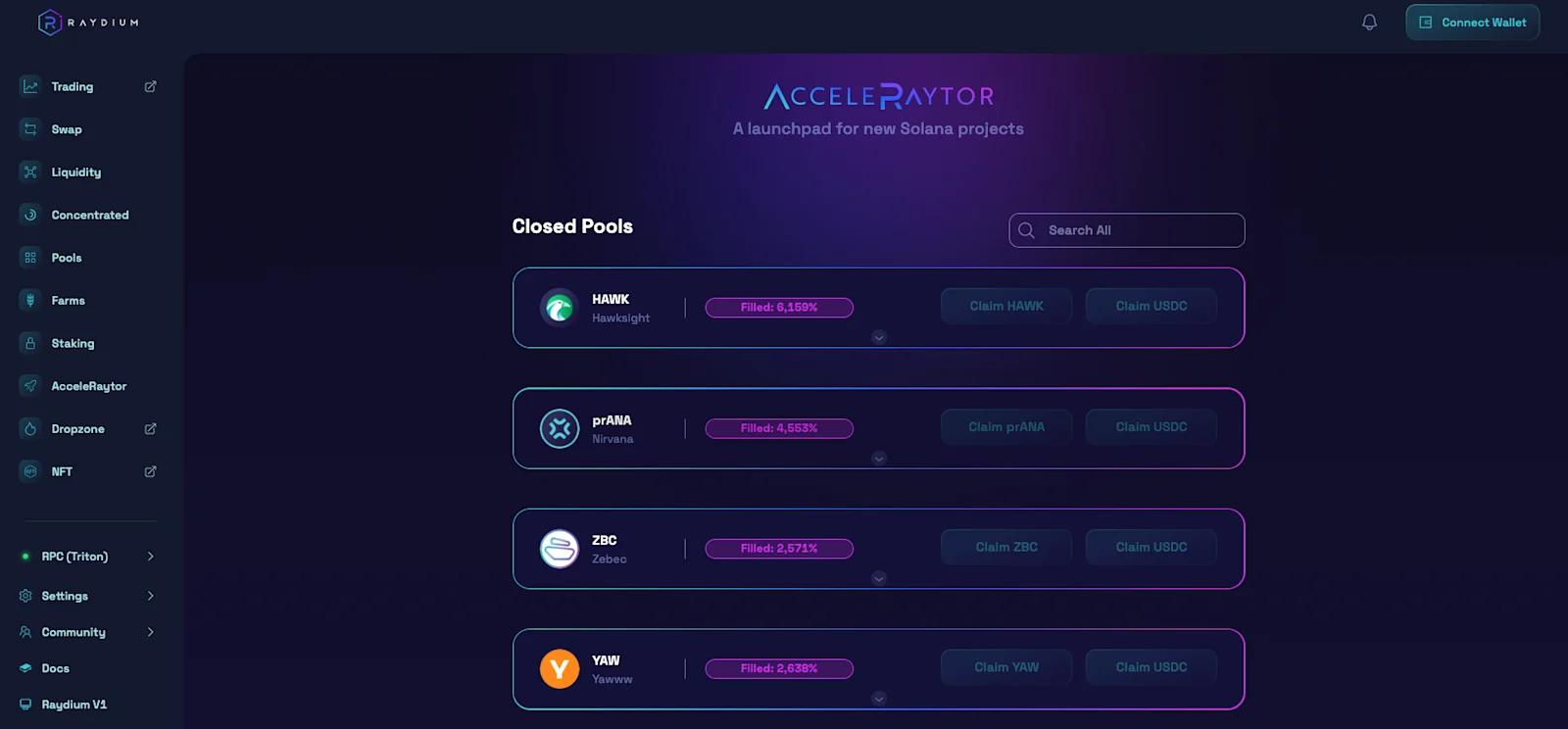

Raydium Promotes New Startups with AcceleRAYtor

Raydium Accelerator

Raydium is a decentralized exchange (DEX) on the Solana blockchain that offers a variety of pools, yield farming opportunities, and swaps.

AcceleRAYtor is an incubation program that allows new crypto projects building on Solana to raise capital through Initial DEX Offerings (IDOs), and get support from Raydium's team.

During the first two launches on AcceleRAYtor, Media Foundation and Mercurial Finance were over-bought by 10,000% and 9,000% respectively.

Because so many users were interested in buying $MEDIA and $MER tokens, and there was a limited amount, they could only purchase a fraction of what they wanted.

This created a lot of FOMO and buzz on Crypto Twitter. If you're a new project, getting a yield farming pool on a high-visibility platform like Raydium can create a ton of demand for your token.

4. Hackathons

Another unique and effective crypto marketing strategy is hosting a Hackathon.

If you’re launching a layer 1 blockchain, L2 solution for Ethereum, or blockchain infrastructure like an oracle, you need developers to build with your code.

One reason why Ethereum is the number one smart contract platform in the world, despite its cost, speed, and scalability challenges, is because of the decentralized applications (dApps) running on the network.

Ethereum ecosystem projects like Aave, Compound, and Uniswap drive massive value to the underlying blockchain and Ethereum infrastructure providers.

Hackathons with attractive prize pools are an excellent way to encourage enthusiastic blockchain developers to build with your tools, raise brand awareness through features and press releases, and accrue value to your project.

For participants, Hackathons offer attractive prize money, incredible opportunities to gain experience, make crypto industry connections, and if they're successful, even win startup funding after the Hackathon ends.

Solana's Hackathon Grows 1,000% in 7 Months

Solana Season Hackathon

Solana’s inaugural hackathon in November 2020, attracted over 1,000 registrants.

Solana's DeFi hackathon in partnership with Serum, a decentralized central limit order book (i.e. decentralized Nasdaq), attracted 3,000 registrants and $400,000 in prizes.

Their third hackathon, Solana SZN, attracted over 10,000 builders and $1,000,000 in prizes across 6 continents.

The Solana ecosystem has blossomed into a worthy competitor to Ethereum, with a rapidly growing network of Rust developers building DeFi protocols, blockchain tools, infrastructure projects, dashboards, and so much more.

Successful Solana Hackathon Projects

Hackathon winners aren’t just flash-in-the-pan projects; some have had incredible success after the hackathon and raised additional funding.

Here are some of the top hackathon alums:

- Mango Markets - Decentralized cross-margin trading platform.

- Psyops - An American-style options platform.

- Synthetify - A decentralized protocol for synthetic assets.

- Solrise Finance - A decentralized P2P asset management and trading protocol.

- StableSwap - An efficient token swap platform for stablecoins and highly correlated tokens.

5. Dynamically Priced Merchandise

One of the most creative and bizarre examples of crypto marketing efforts we’ve seen is the use of limited edition merchandise.

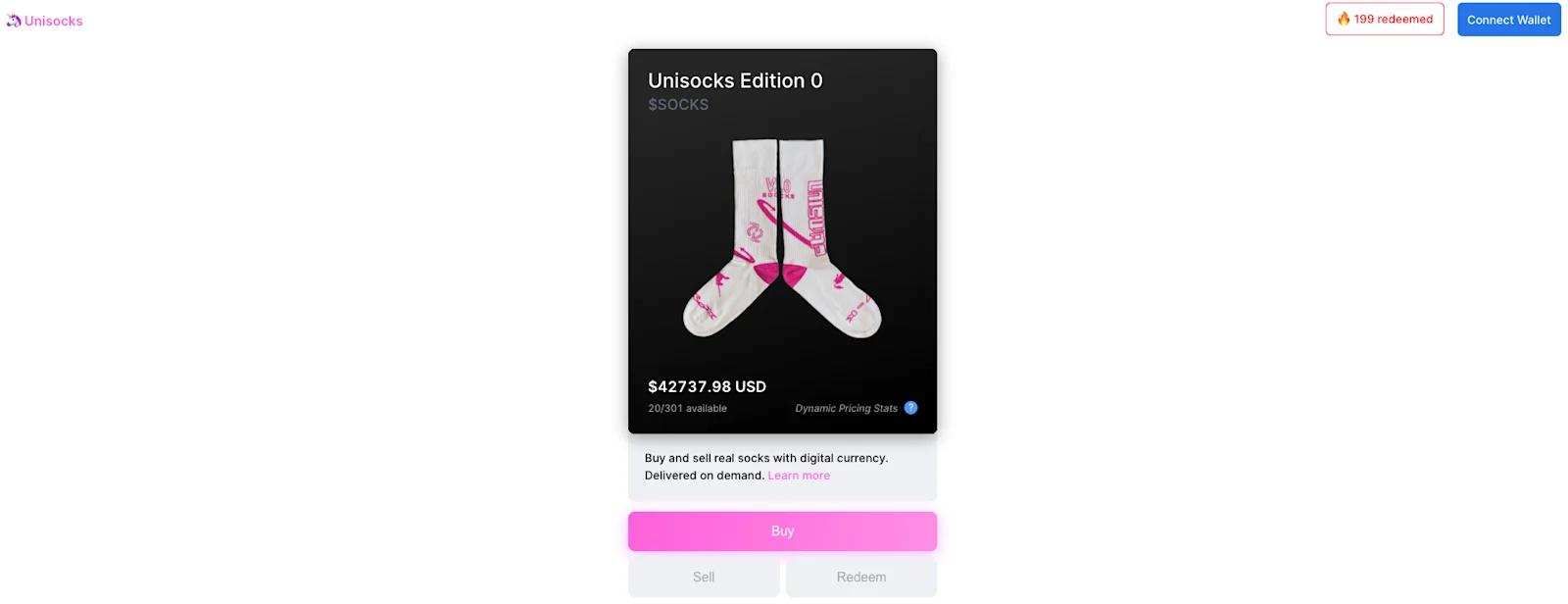

Unisocks Sell for over $50,000

Unisocks Screenshot

Each time a token is redeemed for a pair of socks the price increases along a bonding curve. For example, the first few pairs of $SOCKS sold for $12, $13, $14, $16, $17, $19, $21, and with only 21 pairs left, the current price is a staggering $53,698 USD.

The pure absurdity of this strategy created massive buzz on social media channels, and has inspired new protocols to follow suit like Mango Markets who started selling dynamically priced Caps.

On the more traditional side of branded clothing, Solana opened up a merch store to sell physical goods like sweatshirts, shirts, and socks.

Crypto fans, like sports and music enthusiasts, like to rep their favorite teams. Branded merch stores are a great way to give your die-hard fans ways to show their loyalty, start conversations with their IRL networks, and earn publicity through a number of crypto marketing channels.

6. Limited Edition NFTs

NFTs, or non-fungible tokens, are provably unique tokens used by creators like Beeple to sell digital art, artists like RAC to sell exclusive music, metaverse games like Decentraland to sell virtual real estate, and so much more.

A potential new medium for Web3 content marketing, NFTs are a popular option for startups looking to engage their fans, give them a piece of history, and raise money.

Star Atlas Auctions Blockchain Video Game Art

Star Atlas Background

Gaming projects in the crypto space can take a long time to ship a final product.

When you're building a Massive Multiplayer Online Role-Playing Game (MMORPG) like Star Atlas, it will take years to bring their open-world game to market.

With new editions being released each Saturday starting on April 24th, Star Atlas is auctioning off 14, limited edition NFTs inspired by their in-game designs to raise money and more importantly keep their fans excited.

If your company is in a position to mint non-fungible tokens, creating a limited run of NFTs related to your project could be a fun way to give your users a way to add you to their library of digital collectibles.

7. Integrations

What do software tools like Zapier, Slack, and HubSpot have in common?

They offer a TON of integrations.

Because we're an Elite HubSpot Solutions Partner, let's use HubSpot as an example.

HubSpot integrations with other SaaS platforms not only afford their users more ways to use their product, but it also increases the value of their tool, earns backlinks from their integration partners, and expands their base of users.

Here is another example:

When your favorite sports player gets traded to a new team, do you warm up to their new team, or do you revolt against your favorite player?

For many of us, warming up to another team is the route.

The same is true in crypto.

Lido Solana Ecosystem Integration

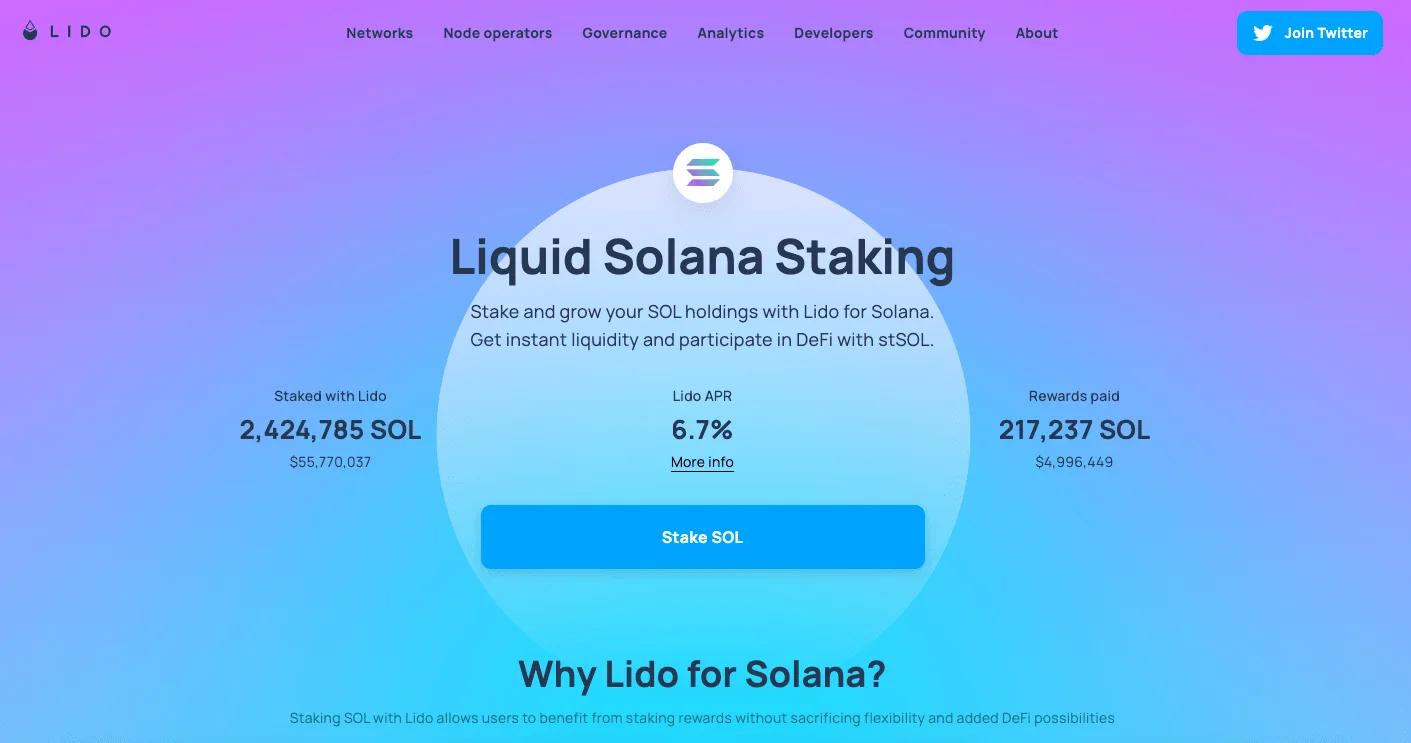

Lido Solana Staking

A great example of this in crypto was the LidoDAO proposal by Chorus One to bring liquid staking to Solana.

Lido is one of the largest staking platforms on the Ethereum network. Now, loyal users of Lido on Ethereum can also stake their SOL through the Lido protocol on Solana.

The beautiful thing about DeFi is code composability, or the ability to assemble code in many different ways, to create novel, integrable protocols. Integrating with other chains not only grows your brand awareness, but also allows you to expand your user base tremendously.

8. Invite-Only dApps

If you've heard Michael Saylor or the Winklevoss twins talk about Bitcoin, you've probably heard that Bitcoin is scarce (only 21 million will ever exist), and it's this scarcity and soundness that makes it an attractive investment like gold.

Similarly, when you're launching a new dApp, pairing sneak-peek videos of what you're building with scarcity can skyrocket demand for your tool.

Phantom Wallet Gives Invite-only Access to Partners

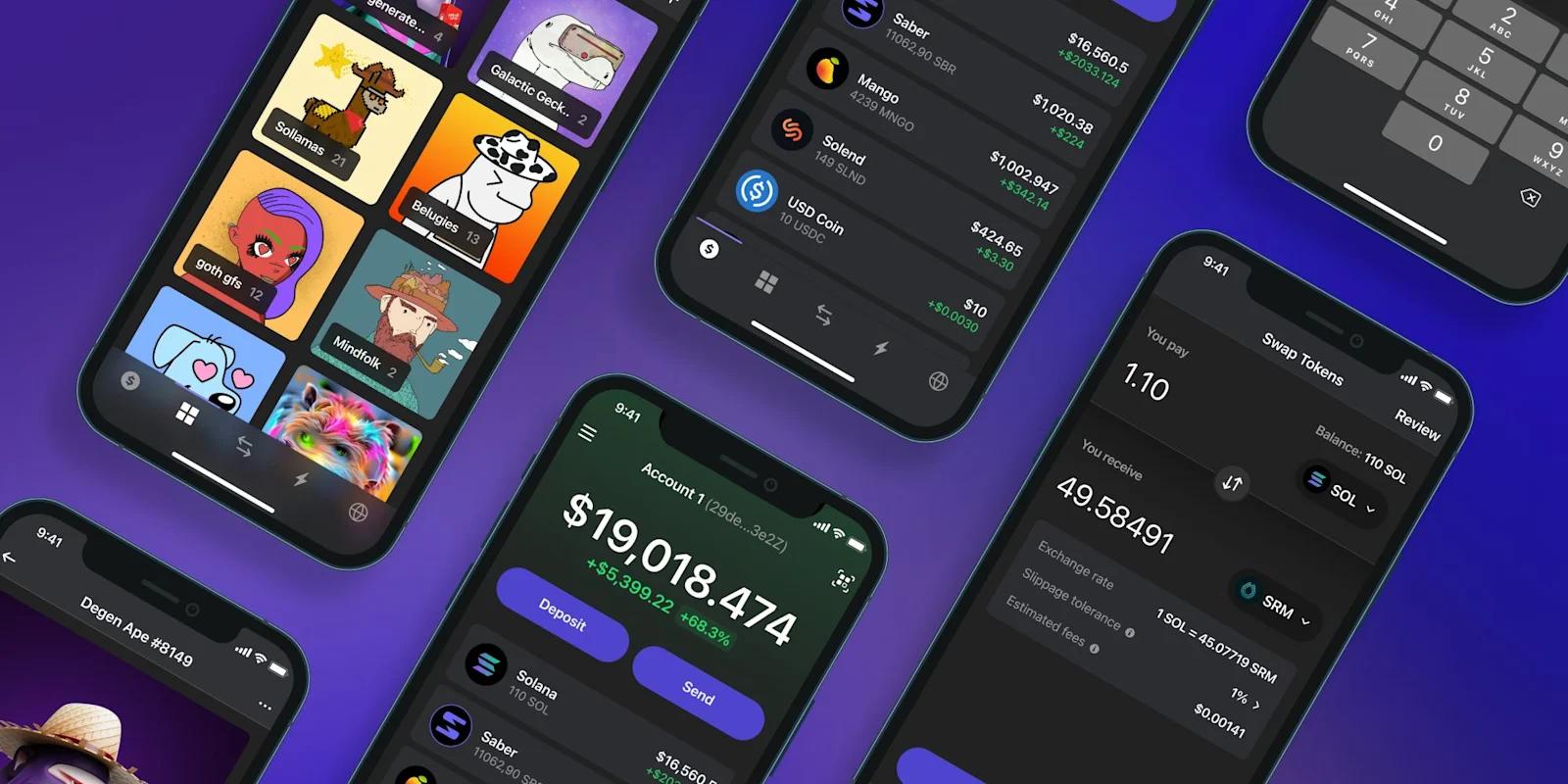

Phantom wallet

Phantom is a new browser-based cryptocurrency wallet that operates on Solana.

Unlike their predecessor Sollet which has an unimpressive user interface and user experience, Phantom is 100% focused on making a web3 wallet that is easy to use.

Getting people to migrate their funds from one wallet to another is a big ask.

From the loss of funds to wallet security and remembering another seed phrase, getting users to switch from one Solana wallet to another is a tough sell.

Here are a few ways Phantom used scarcity and influencer marketing to growth hack their wallet:

- Created a beta access sign up form

- Invited crypto influencers to access the wallet early

- Gave followers access who switched from their old Twitter handle to their new one

- Sent "invite-only" codes to ecosystem projects

9. Community Grants and Bounties

One of the most scalable ways to grow your Web3 project without blowing up your budget is by setting up community grants and bounties.

Instead of hiring a huge team, you open the door to contributors from anywhere in the world. Designers, writers, developers, meme makers, and anyone who supports your mission can get involved and be rewarded for it.

Optimism Uses RetroPGF to Fund Ecosystem Builders

Optimism's RetroPGF (Retroactive Public Goods Funding) rounds reward contributors after they’ve delivered value to the ecosystem. Rather than paying upfront, Optimism tracks impact and allocates funds to those who made meaningful contributions.

Not only does this lower the barrier to entry, but it also creates a positive feedback loop: do good work, get rewarded, earn credibility in the community. This creates a system based on merit that filters out bad actors and amplifies the best ideas.

Why it works:

- Turns users into contributors

- Keeps treasury spend efficient

- Grows community ownership

10. Real-Time Product Dashboards

If your project runs on-chain activity, a real-time dashboard becomes a powerful marketing tool.

Instead of just talking about growth, usage, or TVL (total value locked), you can show it. This creates instant credibility and gives power users, investors, and researchers something to engage with and share.

dYdX Shows Real Metrics

dYdX, a decentralized exchange for perpetuals, has a stats page with real usage numbers updated in real time. You can see everything from trading volume to number of users, without needing to dig through Etherscan.

Dashboards like this build trust, reduce support questions and help onboard power users faster.

11. Thought Leadership Through Developer-Focused Content

Most crypto projects write content for users or investors. But if you’re building tools, protocols, or infra, you need to speak directly to developers.

Publishing technical deep dives, roadmap explainers, upgrade notes, or even opinion pieces on governance gives your project a voice and positions your team as experts worth following.

Polygon Labs Breaks Down Scaling Innovation in Plain English

Polygon has consistently published high-quality technical explainers around zero-knowledge proofs and scaling Ethereum. These posts update the community, help the broader ecosystem understand what’s possible and how to get started.

Strong technical content helps your team stand out in a crowded space and gives developers the confidence to build on your platform. You also increase transparency, build trust and boost long-term visibility through SEO.

12. Ambassador Programs

If you have an engaged community, one of the smartest ways to scale your reach without hiring a marketing team is by launching an ambassador program.

Ambassadors are power users who already love what you’re building. Instead of just giving them a Discord role or badge, you give them incentives to help grow your project. They could moderate chats, create memes, write blog posts or host meetups.

Synthetix Rewards Its Most Active Supporters

Synthetix has one of the longest-running DeFi ambassador programs. Contributors help translate content, build dashboards, run events, and onboard new users into the ecosystem in exchange for SNX tokens, exclusive roles, and direct access to the main team.

This approach:

- Turns fans into marketers

- Costs less than full-time hiring

- Builds long-term loyalty and retention

13. Gamified Onboarding

With gamified onboarding, you can use short, engaging quests to teach users how to interact with your protocol through fun activities, rather than reading lengthy documentation.

Optimism Quests Guide New Users Through Real Interactions

Optimism uses quests that walk new users through tasks like bridging assets, swapping tokens, or voting on governance proposals. At the end of each quest, users can claim NFT badges or even earn tokens.

These quests drive on-chain activity, reduce support tickets, increase confidence, and give users a reason to stick around.

Crypto Marketing Strategies: In Summary

When you're trying to unseat traditional finance institutions like correspondent banks with decentralized alternatives or SaaS solutions like treasury management software with blockchain-powered tech, you need to be clever.

Whether you're a crypto marketing agency, an in-house marketer for a blockchain startup, or if you're still working in the traditional marketing industry, there is a lot to learn from the marketing strategies seen in community-driven crypto startups.

If you're looking for a blockchain marketing team to help accelerate your company's growth, schedule a meeting with one of our sales engineers today!